does instacart take taxes out of your check

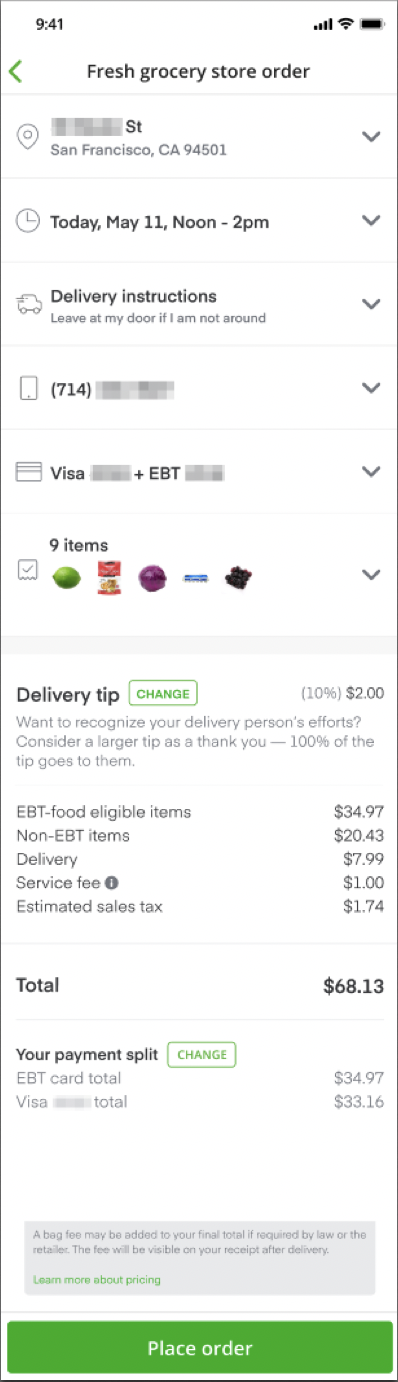

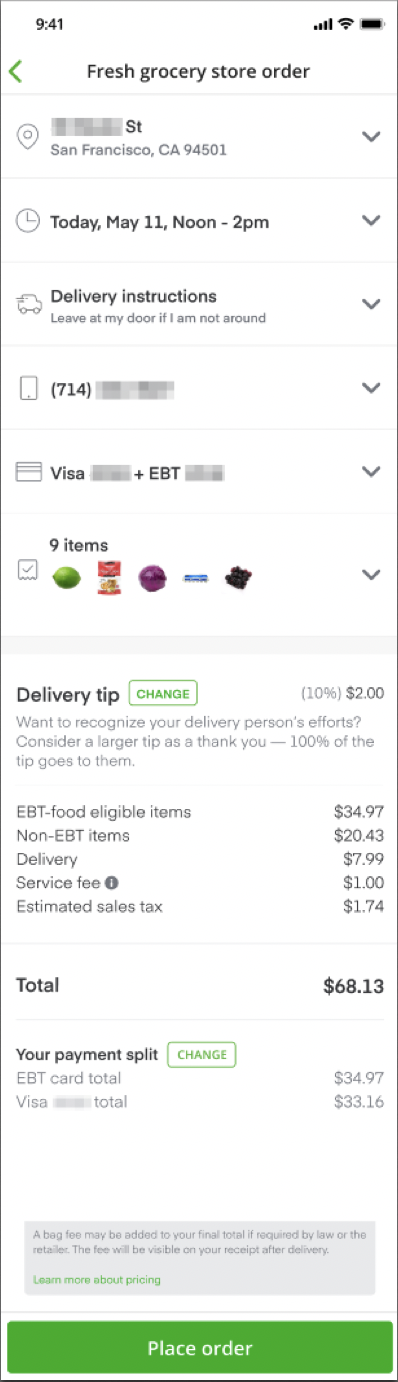

Report Inappropriate Content. The total amount including all applicable taxes will become charged to your payment method on file when you receive your order.

Instacart Taxes The Complete Guide For Shoppers Ridester Com

The taxes on your Instacart income wont be high since most drivers are making around 11 every hour.

. I got my 1099 and I have tracked all my mileage and gas purchases but what else do I need to do before I file. Register your Instacart payment card. No formula just best guess.

So if you received a form that means you made over 600 through the app. 20 minimum of your gross business income. You can save 25 to 30 of every payment and put it in a different account to make saving for taxes easier.

All companies including Instacart are only required to provide this form if they paid you 600 or more in a given tax year. Then if your state taxes personal income youll need to find out the tax rate for your state and withhold accordingly in addition to the 20 minimum for your federal taxes. That means youd only pay income tax on 80 of your profits.

Do i pay taxes on instacart. If you earned 600 or more in 2021 through Instacart in the US Stripe will send an email titled Confirm your tax information with Instacart inviting you to create an account and log in to Stripe Express. If there are any unforeseen circumstances this process could face even longer delays.

However you still have to file an income tax return. The estimated rate accounts for Fed payroll and income taxes. Instacart shoppers use a preloaded payment card when they check out with a customers order.

On my last order they accidentally left the actual store receipt in my bag. Anyone using Instacart for ordering grocery online please be aware that they are seriously gouging you. What Happens if I Dont File Instacart Taxes.

Depending on your location the delivery or service fee that you pay to Instacart in exchange for its service may also be subject to tax. You wont send this form in with your tax return but you will use it to figure out how much business income to report on your Schedule C. Except despite everything you have to put aside a portion of the cash you make every week to cover them.

To make matters worse thats on top of your federal and state income taxes. If you are an independent contractor for Instacart follow the link here to find out more information regarding the deductions that can be claimed. This is a standard tax form for contract workers.

New shoppers can expect to receive their card within 5 to 7 business days. Your self employment tax is. If your net earnings were less than 400 you dont have to report your self-employed income.

Can you deduct your retirement contributions. Because Instacart shoppers are contractors the company will not take taxes out of your paycheck. As an Instacart driver though youre self-employed putting you on the hook for both the employee and employer portions.

There are a few different taxes involved when you place an order. Instacart charged me 190 tips service fee taxes 226. This used to be reported to you on a 1099-MISC but that changed for tax year 2020.

Missouri does theirs by mail. I worked for Instacart for 5 months in 2017. I earned 600 or more in 2021.

I tried calling them. To make saving for taxes easier consider saving 25 to 30 of every payment and putting the money in a different account. As youre liable for paying the essential state and government income taxes on the cash you make delivering for Instacart.

Deductions are important and the biggest one is the standard mileage deduction so keep track of. For simplicity my accountant suggested using 30 to estimate taxes. Tax withholding depends on whether you are classified as an employee or an independent contractor.

Tax Deductions You Can Claim As An Instacart Driver Being classified as a business owner allows you to deduct your business-related expenses and avoid paying taxes on your 1099 earnings. Youll have to pay that 765 twice over for a total of 153. Part-time employees sign an offer letter and W-4 tax form.

Instacart shoppers are contractors so the company will not deduct taxes from your paycheck. Stripe Express allows you to review your tax information download your tax forms and track your earnings. You would face the same penalties as any other business that doesnt file taxes.

Every minute spent figuring out your taxes is one more dollar in your pocket. What percentage of my income should I set aside for taxes if Im a driver for Instacart. This is because the IRS does not require Instacart to issue you a form if the company paid you under 600 in that tax period.

Your account will be on hold once you file a dispute and the investigation may take up to 90 days to resolve. Instacart does not take out taxes at the time of purchase. I saw that the store check out was for 164 before taxes.

If you make more than 600 per tax year theyll send you a 1099-MISC tax form. The last four digits of your card number. The date of the unauthorized charges The amount of the unauthorized charges We recommend reaching out before you dispute unknown charges with your bank.

You dont send the form in with your taxes but you use it to figure out how much to report as income when you file your taxes. The tax andor fees you pay on products purchased through the Instacart platform are calculated the same way as in a physical store. Side Hustle Filing Taxes Tax Time Quarterly Taxes This means that lyft instacart caviar lime bike and all the other on demand companies are not required to withhold taxes from your pay.

For most Shipt and Instacart shoppers you get a deduction equal to 20 of your net profits. According to Instacart their background checks carried out by Checkr could take an average of ten days. By writing off expenses that deals with your driving service you can lower your taxable income and pay less taxes.

Of course many people have received theirs earlier than the ten days or at the scheduled time without issue. Had to hold for over. You dont get the QBI deduction on the 153 in self-employment taxes.

The Stride app that comes with Instacart for tracking miles deductions and earnings estimates 30 going to the IRS. I asked them about it being so high but they had some justifications in their response back to me. Does Instacart take out taxes for its employees.

Estimate what you think your income will be and multiply by the various tax rates. If your order includes both taxable and non-taxable items instacart consists of an estimated breakdown of the taxes included within your order total at. Does instacart take out taxes for employees.

What You Need To Know About Instacart 1099 Taxes

Am I Individual Or Sole Proprietor For Payable 1099 Doordash Instacart

Does Instacart Track Mileage The Ultimate Guide For Shoppers

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Taxes The Complete Guide For Shoppers Ridester Com

What You Need To Know About Instacart Taxes Net Pay Advance

What You Need To Know About Instacart Taxes Net Pay Advance

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Help Center Checking Out With Your Ebt Card

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

What You Need To Know About Instacart Taxes Net Pay Advance

How Much Of My Earnings Doordash Grubhub Uber Eats Etc Is Taxable

Taxes For Grubhub Doordash Postmates Uber Eats Instacart Contractors

How To Get Instacart Tax 1099 Forms Youtube

Instacart Pay Stub How To Get One Other Common Faqs

Instacart Fees Everything You Ll Pay As A Customer Explained

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Guide To 1099 Tax Forms For Instacart Shoppers Stripe Help Support